Not known Factual Statements About Guided Wealth Management

Not known Factual Statements About Guided Wealth Management

Blog Article

The 2-Minute Rule for Guided Wealth Management

Table of ContentsThe smart Trick of Guided Wealth Management That Nobody is Talking AboutThe Ultimate Guide To Guided Wealth ManagementThe Best Guide To Guided Wealth Management8 Easy Facts About Guided Wealth Management Explained

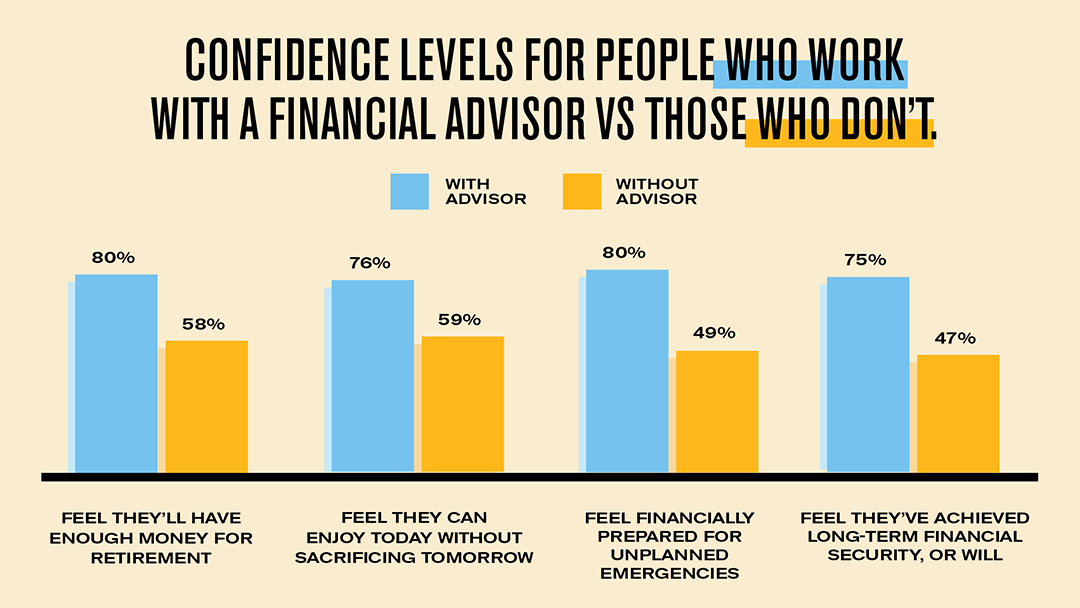

Retired life planning has never been more facility. With modifications in tax regulations and pension guideline, and with any luck a lengthy retired life ahead, individuals coming close to completion of their jobs need to navigate a progressively challenging background to guarantee their economic demands will certainly be fulfilled when they retire. Include an unpredictable macroeconomic setting, and the threat of not having a clear strategy can have a severe effect on retirement high quality and way of life selections.Looking for economic suggestions is a good concept, as it can assist individuals to enjoy a worry-free retirement. Here are 5 ways that people can gain from engaging with an expert economic adviser. Working with an advisor can assist individuals to map out their retirement goals and guarantee they have the right plan in location to meet those goals.

"Inheritance tax obligation is a complicated area," claims Nobbs. "There are many means to steer via estate tax planning as there are a series of products that can help mitigate or decrease inheritance tax obligation. This is among the several factors why it is very important to examine your continuous economic placement." The tax obligation you pay will rely on your specific situations and policies can additionally transform.

The Greatest Guide To Guided Wealth Management

"It can be very hard to talk with your household concerning this because as a culture we don't such as speaking about money and fatality," says Liston. "There's so much you can do around legacy, around gifting and around count on planning. However I stress that so much of society does not understand about that, not to mention have accessibility to it." If you're not making use of a consultant, exactly how do you manage your investments and exactly how do you know you've picked the appropriate items for you? While online services make it much easier for clients to watch their products and efficiency, having an advisor handy can help clients comprehend the alternatives offered to them and reduce the admin problem of handling products, enabling them to concentrate on enjoying their retirement.

Retired life planning is not a one-off occasion, either. With the popularity of revenue drawdown, "financial investment doesn't quit at retired life, so you need an element of know-how to know how to obtain the appropriate blend and the ideal balance in your investment options," says Liston.

Guided Wealth Management - Questions

For circumstances, Nobbs had the ability to help among his clients relocate cash right into a variety of tax-efficient items to make sure that she can draw an earnings and wouldn't need to pay any kind of tax till she had to do with 88. "They live conveniently currently and her hubby was able to take very early retired life consequently," he claims.

"Individuals can come to be actually stressed out concerning exactly how they will certainly money their retirement due to the fact that they do not understand what setting they'll be in, so it pays to have a discussion with a financial advisor," states Nobbs. While saving is one evident advantage, the worth of suggestions runs much deeper. "It's everything about providing people satisfaction, comprehending their needs and aiding them live the lifestyle and the retired life they want and to care for their family members if anything need to take place," states Liston.

Seeking financial recommendations could seem frustrating. In the UK, that is sustaining an expanding suggestions gap only 11% of grownups surveyed stated they Continue 'd paid for economic guidance in the previous 2 years, according to Lang Pet cat study.

The 4-Minute Rule for Guided Wealth Management

"The world of financial suggestions in the UK is our heartland," claims Liston. "If we go back several years, the term 'the Man from the Pru' resonated up and down the roads of the UK. That heritage and the breadth of our suggestions mean that we can offer consumers' demands at any type of factor in their life time which aids construct depend on." M&G Wide range Advice makes monetary recommendations a lot more accessible for more people.

They are experts in advising products from Prudential and other meticulously chosen companions. This is called a restricted advice service.

It's not simply about preparing for the future either (financial advisor redcliffe). A financial adviser can aid adjust your current circumstance in addition to preparing you and your family for the years ahead. A financial advisor can assist you with approaches to: Repay your mortgage quicker Conserve cash and expand your properties Increase your very balance with tax-effective strategies Secure your revenue Construct an investment portfolio Provide your children a head start and assist them safeguard their future Like any kind of journey, when it pertains to your financial resources, planning is the secret

Report this page